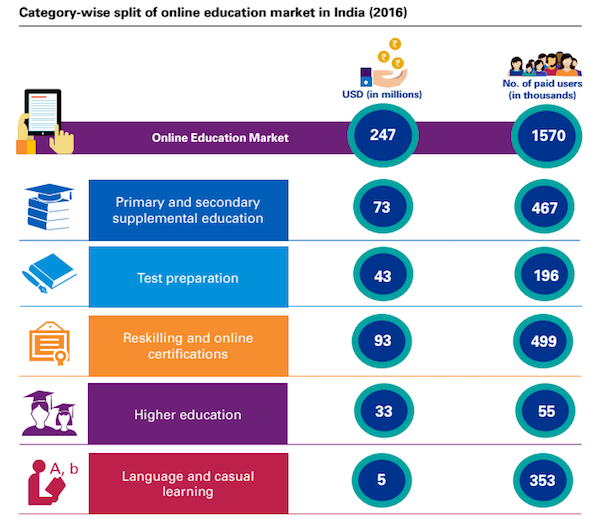

Online education in India will see approximately 8x growth in the next five years, says a recent report by Google, KPMG. This will have a significant impact on the edtech market that has a potential to touch $1.96 Bn by 2021 from where it stands now i.e. $247 Mn.

Traditional education systems (such as classrooms, tuitions) are slowly losing their importance as both students and educators embrace what edtech startups offer – convenience, personalisation, and agility. Then, we have newer concepts such as MOOCs (massively open online courses) gaining popularity amongst students and working professionals, alike. To this end, edtech startups too are making their presence felt in the $100 Bn Indian education sector, according to IBEF.

So what are the factors leading to this growth? What are the expected future trends to watch in this sector? Also, it is intriguing that despite having such large potential, the online education sector is unable to attract large, ticket size fundings, except for a few.

We at Inc42 reached out to a few investors and startup founders to answer these queries for us. Along with decoding the trends and facts mentioned in the Google-KPMG report shared with Inc42, we have tried to give you a quick overall view of the Indian edtech sector as it stands now.

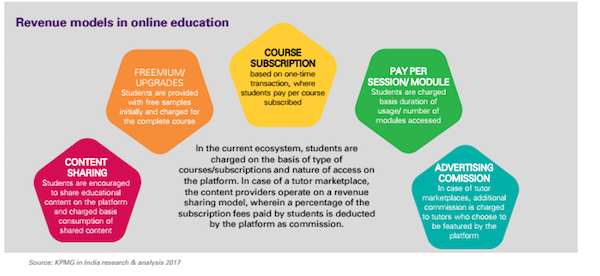

Existing Business Models And Revenue Models In Edtech

The current user base for online education industry in India largely consists of school students and working professionals. Some startups are providing standardised offerings in the form of test preparation content and K-12 learning courses. Then there are startups that are offering skill-based education, and finally, the ones that bring on innovative and new models on deck.

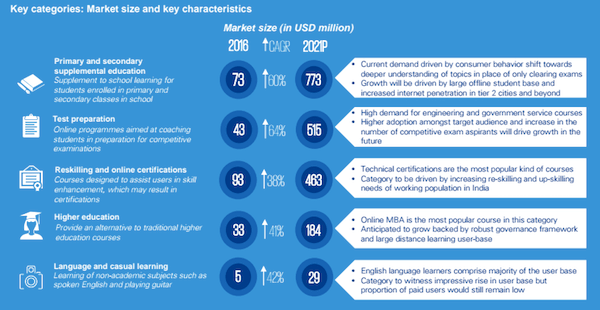

Primarily, there are five business models/categories which are growing at a rapid pace in the edtech sector in India taking online education to the next level. These include primary and secondary supplement education, test preparation, reskilling and online certifications, higher education and language, and casual learning.

From a monetisation point of view too, edtech startups in India have gained pace. Not only investors but the number of parents believing in online tutorials has also seen an upward growth. The recent BYJU’s TV advertisement best describes this. The ad showcases the acceptance of parents when they watch their wards learning concepts on the mobile with BYJU’s app.

If we go by facts, the Google-KPMG report states that it is expected that the paid user base will grow 6X from 1.6 Mn users in 2016 to 9.6 Mn users in 2021. The report also revealed that 44% of online education searches are now coming from beyond the top six metros and there has been a 4X growth in education content consumption on YouTube in the last one year.

In line with below-mentioned revenue models, reskilling and online certification has the maximum paid users – approximately 499K, as per the report. The reason being that this segment is led by working IT professionals, with an eye to enhance their key skills without having to dedicate specific learning hours.

Key Factors Leading To Growth Of Online Education

India is a country of Vedas and Puranas. There were times when education meant spending one’s entire childhood with the gurus in their ashrams. In the 21st century, this scenario has changed drastically and for the better.

With the growing smartphone users, Internet penetration – more than 900 startups in edtech have managed to come up in the past two years. There are a few other factors responsible for the spurt in online education in the country.

Low Cost

As mentioned in the report, online courses offer a low-cost alternative (INR 15K-INR 20K) against the high cost (INR 8 Lakh – INR 10 Lakh) courses from private colleges or institutes in streams such as engineering, medical and commerce & arts. Online education is also a boon in disguise for areas where quality offline education is at an all-time low.

Convenience, Flexibility, And Personalisation

Nitin Bawankule, Industry Director, Google India believes that the perceived convenience increased reach and personalisation offered by online channels are playing a key role in the adoption of online education in India. He further added,

“It is also interesting to note, that high growth in education search queries is now coming in from Tier II and III cities such as Patna, Guwahati, Aligarh, and Kota – which points to the opportunities that growing penetration of smartphones and improving quality of Internet have opened up.”

With regard to students, the report cites that flexibility with commencement dates and variety of study material available are the key motivational factors leading to online channel adoption. Also, they consider peers and Internet search as the top two sources of brand awareness and indicate a quality of course content as the top reason for selecting a specific brand.

However, it has been seen that adoption in this category is much higher among Science students in the higher secondary. These students prefer quality supplementary content to aid them in preparation for competitive exams, in addition to the school curriculum. Commerce/Arts students adopting online courses are relatively lower on account of limited content availability.

Increased Internet Penetration

As per the report, India has witnessed a significant increase in the total Internet user population from 2011 to 2016, with overall Internet penetration of 31% in 2016. Approximately 409 Mn Internet users are expected to grow to approximately 735 Mn by 2021, supported by the exponential rise of smartphone users that reached around 290 Mn in 2016.

According to Kae Capital’s Venture Partner, Shubhankar Bhattacharya, rising incomes, consumerism, and a gradual shift to urban living implies that more and more of the masses seek better and alternative modes of learning – to write a specific competitive exam, to improve their job prospects and clear interviews, for the future of their children, and to perform better at work. He further added,

The fact that smartphones and mobile data are becoming even more mainstream and there is growing familiarity with online payments, suggests that a very significant proportion of the audience will adopt or switch to a new-age learning mode.

Also, with nearly 46% of the Indian population in the age group of 15-40, the rising middle-class population is also playing a key role in the growth of this sector.

Technology: Emerging Growth Driver

As shared in an official statement, Sreedhar Prasad, Partner, KPMG India believes that the emergence of hybrid learning channels, the continuous need for working professionals to learn new skills as well as the emergence of technologies such as big data and artificial intelligence is enabling online education vendors to design customised content.

As Toppr founder Zishaan Hayath stated in a recent Inc42 post, “By leveraging evolved multimedia formats, platforms are allowing students to grasp academic concepts better. The use of machine learning and artificial intelligence gives them the ability to adopt a personalised approach that considers individual unique learning patterns to further enhance a student’s learning experience.”

He also added that by leveraging technology, adaptive practise sessions assess students’ strengths and weaknesses for each particular topic, to give them an efficient way to progress in their academics.

Furthermore, Gartner had earlier predicted that there will be nearly 21 Bn connected things all over the world by the year 2020. This number has been raised to 30 Bn by ABI Research.

Beas Dev Ralhan, the founder of Next Education is a big supporter of Internet of Things and believes it to have enough potential to cause major disruption in the education sector. “Interactive boards and digital highlighters are among the latest devices related to the IoT in the field of education. Similarly, digital scanners aid the learning experience by digitally transferring text to smartphones. Radio-frequency identification (RFID) chips are finding applications in students-related research projects while QR codes are helping to access additional knowledge resources,” he cited while giving examples of IoT usage in education.

In the coming years, it is expected that gamification will be on the rise with edtech startups adopting simulation of concepts to enhance key work skills of professionals or imbibing interest and a better understanding of monotonous subjects like History, Geography or even Science in a better manner.

The report also suggests that consumption of content will evolve through the use of technologies like wearable devices and virtual labsincluding data storage on clouds to enable flexibility of accessing it anywhere, anytime – taking online education to the next level.

Funding Trends In Edtech

Edtech is one of the few sectors which weathered the funding winter experienced in India, going ahead of the curve. As per an Inc42 DataLabs report, around 125 Startups were funded between 2014 and 2016, garnering a total investment of $256 Mn, showcasing an average year-on-year growth of 49% in deals and 149% in total funding. Also, by Q1 2017, funds amounting to $21.34 Mn (disclosed funds) have already been infused in the Indian edtech space across 11 deals.

However, still, the average ticket size of funding in edtech is comparatively less than other major sectors such as ecommerce. Even majority of the most recent funding in Q1 2017 are all less than $10 Mn.

In 2016 also, only Simplilearn, Toppr, BYJU’s, and EduPristine were able to raise beyond $10 Mn. Of these, BYJU’S funding was most significant as it raised over $50 Mn in two rounds of funding, which continued in 2017 with additional (undisclosed) funding from Verlinvest – a Belgium-based diversified investment holding company.

According to Shubhanker, most of these companies have been around in some shape or form for several years now. That has provided them time to not only evolve their model and the form factor in which content is being delivered but also build trust and familiarity with their core audience, which we feel matters a great deal in education, more so than other spaces. He said,

“While it is fair to say that edtech has still never gotten as “hot” as say, ecommerce once was, and that investors are still warming to its potential, the round sizes are probably not the right way to assess company prospects. Unlike many other kinds of businesses, most education companies do not require enormous amounts of capital to achieve scale because the product tends to be built around a highly intangible offering. This capital efficiency plays into the size of the funding rounds as well.”

Prateek Bhargava, founder and CEO, Mindler.com further believes that given the challenging nature of the sector, investors want ventures to reach a critical mass and validate their business models. “While the sector is hot and has glaring inefficiencies to solve, the slow pace of growth in the initial years is making the investors extremely selective. Also, the capital light nature of the sector makes the barriers to entry low and makes the space extremely competitive.”

Online Education: Existing Roadblocks And Future Trends

Learntron’s founder Subbu opines that, for B2B startups, long sales cycles is a roadblock while for B2C startups, the cost of customer acquisition is way too high and eats away into the margins.

Gaurav Munjal, CEO and co-founder Unacademy agreed to this. He added, “In edtech when ticket size is huge, the scale is less. For example when companies are selling high ticket size courses like $1000 per course, then the number of people buying the course will be very small. However, when the ticket size is very small, then the scale is large. So there has to be a balance somewhere between that. I believe, balancing this out and scaling along, in general, will help beat the monetisation challenges for the startups.”

Another point was made by Kae’s Shubhankar who said, “For all that has been said and done in the digital arena, most Indians still feel that high-quality education can only be delivered in a face-to-face setting, by a trusted individual or organisation and are more than willing to pay a premium for such a service. The biggest challenge for new-age education companies, therefore, is to convince their users that they are buying a product that offers the same, if not better, level of service than a traditional institution.”

To an extent, the startups have been able to achieve success in this area. However, education in itself is a largely fragmented market, making it a significantly tough space to crack. As suggested by Mindler’s Prateek, inaccessibility to key decision makers emerges as the top challenge in the B2B space. While edtech ventures are focussing on speed-to-action and deliverables, the stakeholders involved may not be working at the same pace and generally like to take it slow for reasons such as limited budgets, too many options to choose from, fear of parent response or just plain resistance to change.

He further added, “Very often, in the edtech space, the consumer and the customer are different. This is especially true in case of institutional selling or B2B sales. The custodians of decision-making at times are not in sync with user requirements and are slow to respond. This is also the reason that B2C models have seen a faster pace of growth compared to B2B model in the edtech space. The solution here may lie in an innovative go-to-market strategy which can make the captive B2B market more like a B2B2C.”

The report described further trends that can be expected to make a change in the Indian edtech space.

- With ~280 Mn students expected to be enrolled in schools by 2021 and increasing adoption amongst this target audience, online primary and secondary supplemental education is expected to be the dominant category of courses with a 39% market share in 2021.

- At the same time, online test preparation is expected to be the fastest-growing category of online education, estimated to grow at an impressive CAGR of 64% in the next five years.

- Open courses and distance learning enrollments in India to rise to around 10 Mn in 2021, growing at a CAGR of around 10%.

- 280 Mn job seekers are expected to enter the job market by 2050, thereby opening the gates for quality skill enhancement training options.

- Government initiatives such as SWAYAM, E-Basta, Rashtriya Madhyamik Shiksha Abhiyan (RMSA), Skill India, and Digital India will enable the infrastructure needed by students to study online.

In Conclusion

Education is paramount to an emerging nation like India. While the government’s slogan of Digital India is slowly taking shape with fintech and big data segment (among others) benefiting from the move, the question arises – are skill and knowledge the same for an emerging population, as education? As mentioned, legacy ways of imparting education are being overtaken with modern, tech-friendly methods. Companies such as Emotix Technologies have even gone a step further and started integrating actual robots to supplement a child’s learning curve.

With imminent layoffs and job scarcity, working professionals too have taken to upskilling, reskilling at any and all stages of their careers in order to stay ahead of the automation curve. There can be no doubt about it: online education by edtech startups is here to stay.

But it is this concluding opinion by Aditi Avasthi, CEO, Embibe.com that defines the state of online education startups as they are right now,

[“source-perryvillenews”]